Table of Contents

VA Form 21P-8416 Printable, Fillable in PDF – This document is used by the Department of Veterans Affairs to submit a claim for medical expenditures incurred as a result of service-related injuries or illnesses. A veteran would utilize this document, which is formally known as a VA Form 21P-8416, to seek assistance from the Department of Veterans Affairs for the cost of medical bills or the cost of transportation to and from medical appointments. This form asks for the veteran’s complete name, VA file number, and social security number, as well as the medical expenditures that are being claimed on his or her behalf, among other things. Once all of the necessary information has been gathered and submitted to the VA, the amount of the veteran’s compensation may be determined.

What Is A VA Form 21P-8416 And How Does It Work?

A Medical Expense Report is a name given to this form. The VA Form 21P-8146 is used by the Department of Veterans Affairs of the United States of America. This form will be used by a veteran to claim medical expenditures incurred as a result of his or her service. Amounts paid for medical treatments or transportation to and from medical appointments are examples of what is meant by “medical expenses.”

The claimant’s personal information is required in the first part of this form. This contains the following information: complete name, social security number, VA file number, and mailing address. Following that, you may begin listing your medical bills. When calculating transportation charges, you must provide the name of the medical institution you visited as well as the number of kilometers you drove. Make a note of how much you spent on this visit. When it comes to medical bills, make a detailed account of each item and how much you spent on it. It will be computed, and the VA will use the form to assess how much of the cost may be reimbursed by the government.

The Most Frequently Encountered Applications

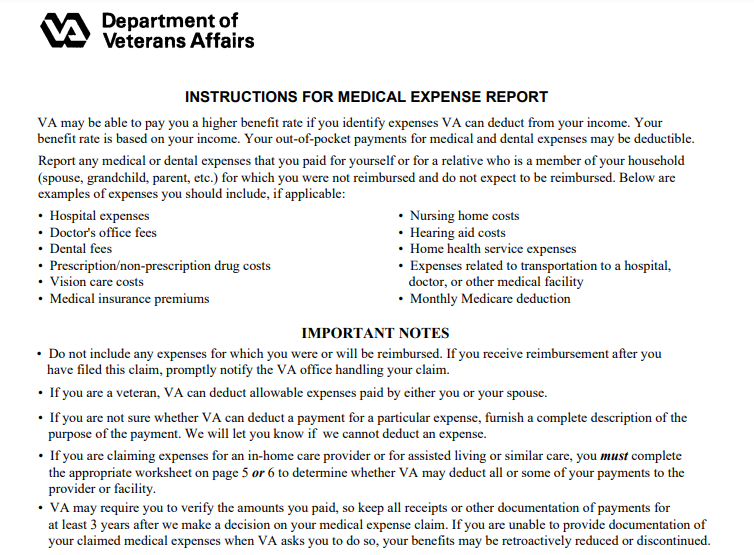

If you have paid medical or dental expenditures for yourself or a relative who is a member of your household, you should complete this form to record such charges. Hospital expenses, doctor’s office fees, dental fees, prescription/non-prescription drug costs, vision care costs, medical insurance premiums, nursing home costs, hearing aid costs, home health service expenses, expenses related to transportation to a hospital, doctor, or another medical facility, and a monthly Medicare deduction are all examples of common expenses to consider.

The Components Of A VA Form 21P-8416 Are As Follows

Among the parts of a VA Form 21P-8416 are the following:

- Information about the individual

- Mileage reimbursement for medical-related travel in a privately owned vehicle.

- Expenses for an in-home attendant

- Medical Expenses are broken down into their parts.

- Worksheet for Expenses Associated with an In-Home Attendant

- For Assisted Living, Adult Day Care, or a Similar Facility, use this worksheet.

Instructions On How To Complete The VA Form 21P-8416

- Information about the individual

- Veteran’s first and last name

- The veteran’s middle name is

- Name of the veteran’s last name

- Veteran’s surname as a suffix

- Number of the veteran’s social security card

- Number of the Veterans Administration’s file

- The claimant’s full name is

- Address

- Number of a telephone

- Change of mailing address

- Claimant’s electronic mail address

Mileage reimbursement for medical-related travel in a privately owned vehicle.

- Travel expenses to and from a hospital, doctor’s office, or other medical institution

- The medical institution to which the patient traveled

- The total number of roundtrip miles traveled

- The amount that has been refunded by another source

- The date on which you traveled

- Who needed the travel?

Expenses for an in-home attendant

- Provider’s full name

- Hourly rate x amount of hours worked

- The amount that has been paid

- The date on which the payment was received

- Who was it that paid?

Medical Expenses are broken down into their parts.

- Expenses for medical treatment

- The amount that has been paid

- The date on which the payment was received

- Provider’s full name

- Who was it that paid?

Worksheet for Expenses Associated with an In-Home Attendant

- Whether or whether the claimant is the handicapped individual

- You should know whether the VA concluded that you are entitled to a special monthly pension (which implies a pension at the aid and attendance or housebound rate, or a Parents’ DIC at the aid and attendance level) or not.

- Whether the main role of the in-home attendant is to provide you with health care services or to offer custodial care, it is important to understand the differences.

- It doesn’t matter if you’re receiving a special monthly pension.

- Whether the main role of the in-home attendant is to offer you health care or custodial care, it is important to understand the differences between the two.

- Whether the disabled person needs the health care services or custodial care that the in-home attendant delivers to him or her as a result of the disabled person’s mental or physical handicap, the in-home attendant must be able to demonstrate that he or she does.

- When it comes to providing the handicapped person with health care and/or custodial care, whether it is the main obligation of the in-home attendant is debatable.

- Dining, bathing/showering, dressing, transferring, and using the toilet are just a few of the activities that an attendant can assist with. Other tasks include grocery shopping, food preparation, housekeeping and laundry, managing finances (including handling medications), using the telephone, and transportation for non-medical reasons.

- Certification that the information provided is accurate

For Assisted Living, Adult Day Care, or a Similar Facility, use this worksheet

- Whether the costs are incurred as a result of the handicapped person’s care in a hospital, inpatient treatment facility, nursing home, or VA-approved medical foster home, the charges are tax-deductible.

- Whether the facility is licensed, whether the facility’s staff or the facility’s contracted staff provides the disabled person with health care or custodial care or both, whether the facility is staffed 24 hours per day with caregivers, and whether the facility is staffed 24 hours per day with caregivers

- Whether the claimant is a handicapped person, a veteran, a surviving spouse, or the child of disabled parents, the process is the same.

- If the VA has concluded that you are qualified for a special monthly pension, you will receive a notification.

- You should consider if the provision of health or custodial care by the institution is the major reason for your residence or attendance at daycare at the facility.

- It doesn’t matter if you’re receiving a special monthly pension.

- What level of health care or custodial care the institution offers to the disabled person is based on whether he or she needs such services as a result of the disabled person’s mental or physical handicap

- The facility’s ability to offer health and/or custodial care to the handicapped person, and whether or not this is the major reason the disabled person resides in the institution or attends daycare at the facility.